Fertility Policy For Rich Countries

A brief proposal to fix Social Security and grow the population

This was a timed post. The way these work is that if it takes me more than one hour to complete the post, an applet that I made deletes everything I’ve written so far and I abandon the post. You can find my previous timed post here.

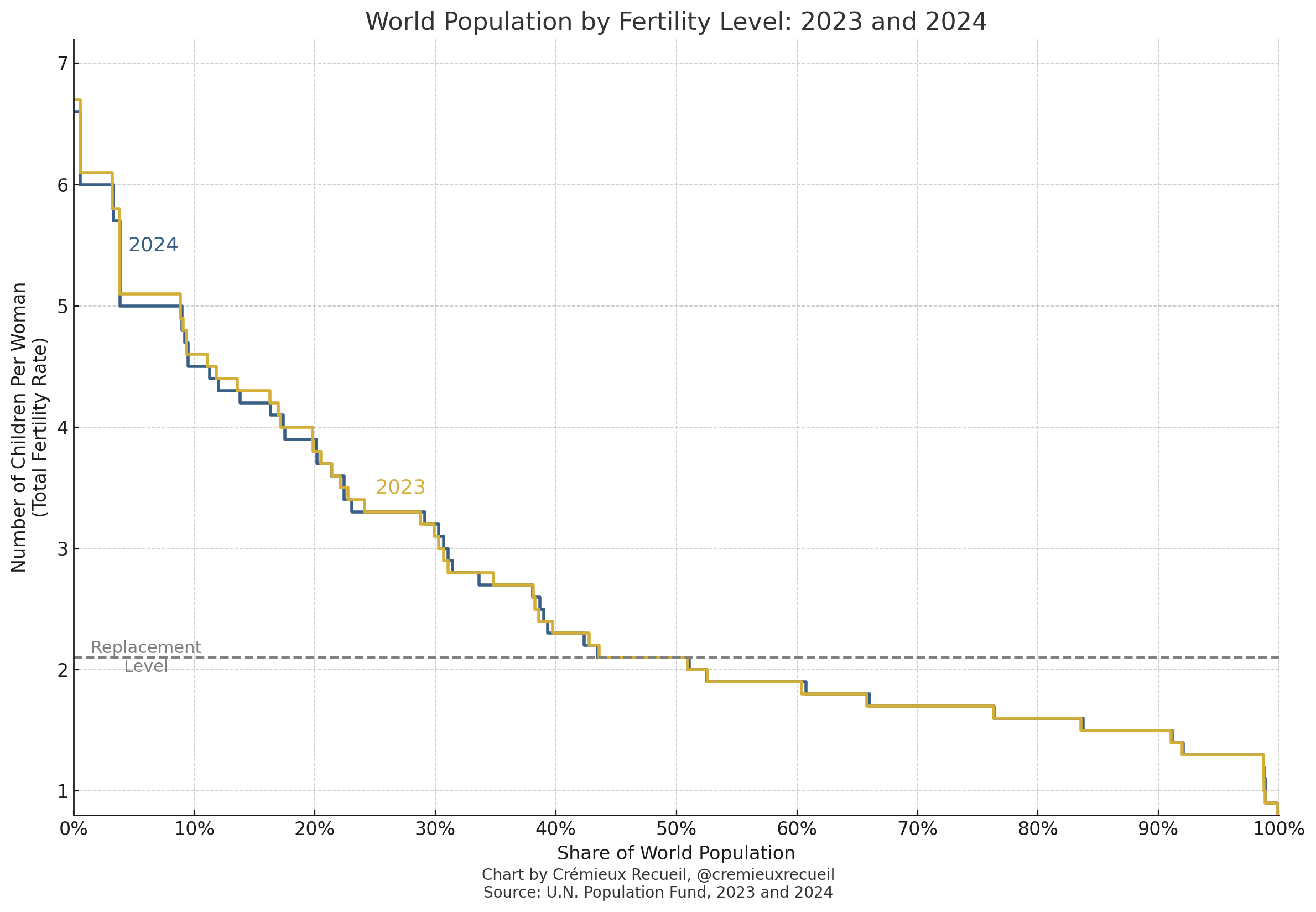

Global fertility is likely to drop below replacement in the near future. For about half of the world’s population, that’s already the case.1

Much of infertile world is the wealthy, developed part that does most of the innovating and building that makes it possible for so many of us to be alive and prospering today. For those of us who intend to live well into the future, that’s not a happy fact, and if we want to live better lives, it’s a fact that demands a solution. Unfortunately, child benefits intended to promote fertility tend to have only small to modest effects. A problem with that inference is that most child benefits have also been small to modest in terms of generosity. In truth, massive benefits have not been tried, and, indeed, may seem to make little fiscal sense.

But Robin Hanson has an interesting proposal that might just work, and could fix Social Security in the process. The idea is simple: Let parents claim a portion of the taxes their children pay.

I’ve taken this idea and edited a bit, but from here on, I will be referring to it as the ‘Hanson Scheme’. I’ve added in that child policy should include tax credits for each child’s early years. As an inducement, you could have a modest refundable tax credit, and if your aim is to make the tax credit induce higher-income families to have births because you want births to families who will tend to produce children that pay more taxes, you can also add in non-refundable tax credits.

The proposal looks like this:

Now, for the explanation.

Replacing Social Security

Social Security is a Ponzi scheme,2 and without high fertility, its current incarnation cannot work. For the sustainability of the program, the number of people drawing down the fund is just too great compared to the number of new workers being introduced into the labor force. This ratio has fallen substantially over time, owing to improvements in longevity, falling fertility, new financial devices, changes in retirement norms, and increased rates of disability, among other factors.3

Social Security can be replaced with the modified Hanson Scheme through a multi-decade phaseout period in which individuals past a certain age will be entitled to their benefits, with progressive drop-offs in the amounts younger and younger participants are entitled to. The Hanson Scheme would then see the programme replaced in a pronatal fashion, with payouts to parents in the form of fractions of the taxes paid by their own children.

In the Hanson Scheme, the lifetime value of the payouts should be left uncapped. This is where the massive pronatal transfer side of the scheme comes in: uncapped benefits from the taxes of people’s children mean more kids net higher total payouts, and making kids more productive does the same.4 If parents obtain a constant fraction of the taxes their children pay, the upside to a given birth could be enormous. Because the transfers in this scheme are dependent on ongoing taxation and made immediately available, there will not be a funding issue like there has been for Social Security.

In short, this style of transfer could enable incredibly large, sustainable transfers to people invested in the future of the country.

Raise Your Kids

Making payouts contingent on some measure of ‘being there’ and an appealable ‘doing a good job’ for children prior to adulthood encourages parents to stay loyal to one another, as well as to pay child support, to take responsibility for kids that might be theirs, to avoid abuse, and so on. The Hanson Scheme is one that is aligned with the key, and in many ways, demolished, family value of actually raising your children instead of neglecting or abandoning them. In this sense, the program may help to limit divorces, promote marriages, and accordingly, constrain any of the potential, malign influence of single parenthood.

Parents for Career-Extending Policies

The Hanson Scheme would compel parents to prefer policies that extend the time their kids are in the workforce. This means avoiding unnecessary education, like taking general ed classes out of university educations and shortening the time children spend before high school graduation.5 Likewise, parents would be incentivized to have their kids accelerate in school. Acceleration would be both with respect to time and to learning, because that would mean entering the workforce earlier and staying in longer, as well as entering it better, earning more all the while.

If a grandparental sum is paid out, the Hanson Scheme would also encourage parents to invest in getting their kids into mature adulthood, out of the house, and on their own feet as rapidly as possible. Parents would have an investment, not just culturally, but economically in helping their children to mature. In a world where kids appear to be extending their adolescence well into their 30s, this could be very important.

The Hanson Scheme means reclaiming kids’ lives from an overgrown education system and encouraging parents to push kids into having families of their own.

Fairness in Fertility

The Hanson Scheme is undoubtedly unfair with respect to the infertile. Most of the infertile can be helped with in vitro fertilization and other assisted reproductive technologies (ARTs) available today. Because of this fact, the Hanson Scheme would increase the demand for universal IVF coverage, so that fertility can be further enhanced and made more equitably distributed. Additionally, if there is universal IVF, innovation in ARTs would undoubtedly follow the same trajectory as innovation in areas Medicare and Medicaid touch: that is, there would be more investment in order to capture government funds.

Adopt, Foster, and Raise

The Hanson Scheme should be extended to encompass adoptions and fostering. By applying to foster children, it may encourage more of the stereotypical ‘bad foster family’ home that over-adopts children and raises them poorly, but it may also increase the diversity of families participating in foster care, potentially improving investments into the system, while almost-certainly improving the availability regardless of its impacts on care quality. Just as well, this could help to bring back adoption, which has declined as a practice in recent years.6

Retire Earlier, Perhaps?

Because of the scale of these payouts and how they’ll grow as parents age and their children advance in the workforce, the Hanson Scheme might negatively impact the number of workers by providing parents with enough money to retire quite a bit earlier, comfortably. While possible, I don’t think this should be a major concern. If if is true, then the program will have been a success, since it will have generated enough additional workers to make earlier retirements possible—a wonder in its own right!

A downside of earlier retirements is that there could be reduced time for older workers to pass on their knowledge and skills to the younger crop of workers. I don’t think this is really avoidable if people do retire earlier on the payouts from their kids’ taxes. An upside is that there would be increased churn in senior positions, and novel ideas would experience greater rates of uptake in the work force, potentially even in academia, and so on.

Earlier retirement is a truly mixed bag possibility that follows from how potentially generous the Hanson Scheme is, but I believe it’s worth it.

Clarkian Equality

Individuals who have low incomes tend to have children who go on to earn higher incomes, and individuals who have high incomes tend to have children who go on to earn lower incomes. This is a description of regression to the mean, and because of it, the payouts will help to equalize household incomes across generations.

Parents from poor households will tend to earn more than expected, because their kids will usually out-earn them, and parents from rich households will tend to earn more as well under the Hanson Scheme, but they’ll still earn somewhat less than they might themselves earn directly.

This asymmetry possibly dovetails with early retirement incentives, but it also presents an alternative possibility that the very poor, who have somewhat poor kids who will disproportionately not pay any amount or a large enough amount in taxes will not be benefitted much by the system. So, while equality should be promoted with enough mobility, the system may also end up highly regressive in nature, under-providing for the relatively small number of chronically poor workers who age into being retirees.

But, if a grandparent payout is enabled, then these chronically poor—who tend to have higher fertility anyway—would likely end up with at least something by old age, and potentially still quite a bit more than what they could expect under existing Social Security.

Don’t Cheat Your Parents

Most people love their parents. Most people hate paying taxes. People will probably hate paying their taxes less if those taxes are crucial to sustaining their parents’ lifestyles. Moreover, their parents will be aware of non-payment, and they’ll be tuned into the success of their kids, above and beyond what’s typical nowadays.

The Hanson Scheme promotes a society of closer, more internally open families.

What About Disability?

Social Security does not just pay for retirees, it also covers the disabled and survivors of parental or spousal death and whatnot. Keep it around for those, but transition retirement over to the Hanson Scheme; that way, the more expensive part of Social Security is eliminated from the budget, and the less expensive, more sustainable, and more genuinely necessary part is kept behind.

What of the Haters and Losers?

People who don’t want to or can’t have families after all is said and done simply won’t be provided automatic access to this Social Security replacement. This may seem unjustifiable, but to a family-oriented society, it should be considered a fine trade-off. The reason is, families are accorded more moral value than singles. Families are the basis for the future—of the country and of humanity in general. Without families, the country dies; with single people alone, it dies. Single people are already leeching from families in a grand sense, and all redistribution from single people away from families reduces the odds society continues and improves. The Hanson Scheme as a Social Security replacement merely reifies acknowledgement of that fact into law and places the family unit on a pedestal, and if single people want in, they have to buy all or part of a transferable right to a person’s future tax revenues from parents.

The Hanson Scheme in Brief

The Hanson Scheme

Incentivizes having kids

Incentivizes raising kids, raising them well, and both forming and maintaining families

Incentivizes investments in universal IVF and other form of ARTs

Incentivizes foster caring and adoption

Supports turnover from the old to the young in roles across the economy

Promotes equality across households

Aligns parents with better educational norms

Discourages tax cheating

The Hanson Scheme is worthy of consideration, and I’m sure I haven’t noticed all of the benefits.

The value to the government of an additional laborer is a very large amount; a higher growth rate means the debt per person can be reduced substantially very rapidly. We already know that immigration is a substantial tool in the arsenal for reducing the national debt, and births could average even better. People do respond to cash incentives when it comes to having kids (see: the repeated hammering on this point from Lyman Stone), and this is just a very large cash incentive, so I don’t doubt it would have a considerable effect.

But being so large, would it be worth it?

Certainly! IVF is expensive, and IVF still easily passes a cost-benefit test. Even siphoning off a sizable fraction of each additionally-born laborers’ lifetime tax revenue to their parents would leave that statement true.7 There is no doubt that going all-in on massive, direct, child-to-parent transfers8 would be good for the budget if it acts as a sizable stimulus to the birth rate.

The Hanson Scheme should not be all the pronatal policy governments attempt. They could do it and also support tax credits—as noted above—and efforts to reduce the cost of child care, push back against abortions, create cultural impetus (e.g., in the form of ‘medals for mothers’ if it can be set up in a workable way), engage in tax burden reductions for parents, structure pro-family leave policies, and so much else.

But if the society-wide pro-family realignment entailed by the Hanson Scheme doesn’t work, then God help us, because I don’t see much else that would do better.

In a previous version of this chart, I had a plotting error that resulted in incorrect lines. This has now been corrected in this version. The U.N.’s provided data is also imprecise, resulting in this chart looking somewhat optimistic for global fertility in both of the years I’m displaying data for.

I am fully aware of why people reject this framing, and I find the particular argument that Ponzi schemes are fraudulent and Social Security is not to be risible rather than serious due to its irrelevance. Calling Social Security a Ponzi scheme seems apt and understandable, which is why it’s valuable, even if it’s not a wholly accurate description.

Changing the inflation measure used for cost of living adjustments to a slower one and raising the retirement age could also go a long way to improving the sustainability of Social Security, but they would ultimately only be stop-gaps, much like immigration, uncapping contributions, and raising payroll taxes.

It is worth noting here that the costs of parenting scale sublinearly with the number of children, whereas the returns under the Hanson Scheme would likely be about linear in the number of children. Parental age and mutational load effects militate against this strict linearity in expectation, but parents also improve at parenting as they age up, as a counterbalance.

Since time in higher education is a major reason for people to delay childbearing and family formation, reducing time there also helps to promote earlier family formation, encouraging fertility organically through that route.

Another practice this might bring “back” or, for most ancestries in the U.S. forwards, is arranged marriage to promote high-tax yield children and parenting that aligns on child investment preferences.

Additionally, it might even make sense to couple this with progressive tax reductions with child numbers, so parents of many children have reduced personal income tax levels. Since parental payouts would likely be primarily out of payroll taxes, this may not be as problematic for the tax base as it seems at a glance.

At a strongly fixed percentage, to avoid parents dominating their kids’ pocketbooks.

The main difference I had in mind is to create a transferable asset out of parents' right to a transferable % of their kids future tax payments. So parents could sell part of those rights to pay for parenting expenses.

I love the brainstorm. However,

1) Enslaving your own children is a loser.

2) Cutting retirement benefits for the childless (or low fertility) is a loser.

I predict the political viability of this plan as negative 5000%. I think it would also cause massive strife within families (imagine how much money grubbing tiger parenting we will get when your children are literal slaves who have to pay you).

All of that said, I support the general thrust. Here is a much simpler and more politically viable change:

1) Current SS benefits go completely untouched because they are the third rail of politics.

2) Current payroll taxes are increased on people who have fewer kids and lowered for people that have more kids. Basically, raise the X% that SS/Medicare collects but give a Y% payment per kid. If you have a lot of kids Y% can even be greater than X%.

Trying to align premiums and claims on retirement insurance is a lot easier to do by changing premiums and changing claims. The insurance justification is that kids are future taxpayers and so people taking the expense of raising them are paying payroll taxes in another form. People who don't take on this expense need to subsidize those that are so they can collect when they are older.

The other big thing that would help fertility is to get school choice whoever we can. We already spend a lot on children but unfortunately we fund systems and not students which means we get a lot less fertility benefit out of each dollar.